Human Resources > Workforce Administration > Search > Employee > Employer Reporting

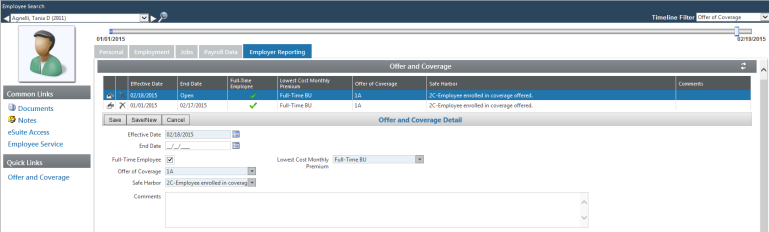

The Offer and Coverage section on the Employer Reporting tab tracks employee information to be reported in Part II of the 1095-C form required under the Affordable Care Act (ACA).

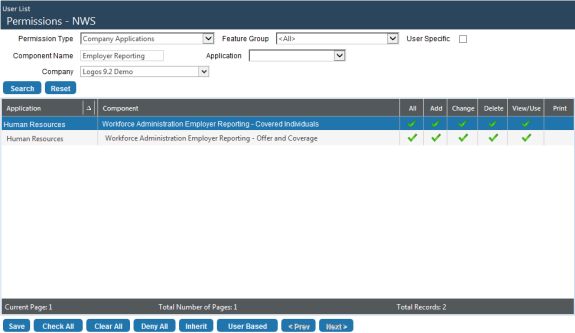

Note: For the Employer Reporting tab to be visible, a user needs a minimum of View/Use permission to the following two security components on the Permissions page in Security Maintenance: Workforce Administration Employer Reporting-Covered Individuals and Workforce Administration Employer Reporting-Offer and Coverage. ![]() Steps.

Steps.

Existing Offer and Coverage records are listed in a grid by effective date in descending order. Effective date ranges may contain gaps.

To create a new Offer and Coverage record, click New; to edit an existing record, click the Edit ![]() icon. In either instance, the

icon. In either instance, the ![]() Offer and Coverage Detail section opens.

Offer and Coverage Detail section opens.

| Field | Description |

|---|---|

| Effective Date | Required. There can be gaps in effective dates. |

| End Date | |

| Full-Time Employee | Affordable Care Act full-time status. Used on the 1094-C employer summary form to report number of full-time employees per month. |

| Offer of Coverage |

Used on the 1095-C to report number of Offer of Coverage. Select the appropriate code from the drop-down. Valid codes come from validation set 548 (see below). |

| Safe Harbor | Used on the 1095-C to report Applicable Section 4980H Safe Harbor. Select the appropriate code from the drop-down. Valid codes come from validation set 549 (see below). |

| Lowest Cost Monthly Premium |

Used on the 1095-C to report the employee share of the Lowest Cost Monthly Premium, for self-only minimum value coverage. Select the appropriate code from the drop-down. Valid codes are defined on the Lowest Cost Premium page in Maintenance. The selection of this code drives the cost. To update the cost, use the Create Event function. Excluding comments, data is copied forward from the prior event, and the prior record ends. |

| Comments | Free-form text. |

For customers who do not use New World ERP's Benefits Administration product, a Covered Individuals section is available here, also, to track individuals to be reported in Part III of the 1095-C form.

Reportable plans should have the 6055 Reporting check box selected on the Benefits Administration Plan Entry page.

Note: The Dependents section in Benefit Plan Detail is not locked down after the last used date.

To set up this validation set, navigate to Maintenance > new world ERP Suite > System > Validation Sets.

| Code | Description |

|---|---|

| 1A | Qualifying Offer |

| 1B | Minimum essential coverage providing minimum value offered to employee only |

| 1C | Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to dependent(s) (not spouse) |

| 1D | Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to spouse (not dependent(s)) |

| 1E | Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to dependent(s) and spouse |

| 1F | Minimum essential coverage NOT providing minimum value offered to employee, or employee and spouse or dependent(s), or employee, spouse and dependents |

| 1G | Offer of coverage to employee who was not a full-time employee for any month of the calendar year and who enrolled in self-insured coverage for one or more months of the calendar year |

| 1H | No offer of coverage (employee not offered any health coverage or employee offered coverage that is not minimum essential coverage) |

| 1I | Qualified Offer Transition Relief 2015: Employee (and spouse or dependents) received no offer of coverage, received an offer that is not a qualified offer, or received a qualified offer for less than 12 months |

To set up this validation set, navigate to Maintenance > new world ERP Suite > System > Validation Sets.

| Code | Description |

|---|---|

| 2A | Employee not employed during the month |

| 2B | Employee not a full-time employee |

| 2C | Employee enrolled in coverage offered |

| 2D | Employee in a section 4980H(b) Limited |

| 2E | Multiemployer interim rule relief |

| 2F | Section 4980H affordability Form W-2 safe harbor |

| 2G | Section 4980H affordability federal poverty line safe harbor |

| 2H | Section 4980H affordability rate of pay safe harbor |

| 2I | Non-calendar year transition relief applies to this employee |